22

Refined results22

Refined resultsCard limit

NOW

£ 17.99

£ 29.99

Cards Against Humanity Inspired Card Game

1071 bought

NOW

£ 5.99

£ 19.99

These Cards Will Get You Drunk Card Game

8 bought

NOW

£ 9.89

£ 14.99

App Center Download Card

- Brand: MAQIO LIMITED

- Gender: Unisex

1 bought

NOW

£ 11.87

£ 19.99

UNO Showdown Quick Draw Family Card Game

- Brand: MAQIO LIMITED

- Gender: Unisex

24 bought

NOW

£ 7.91

£ 14.99

The Awesome Game of Meme Card Game

- Brand: MAQIO LIMITED

- Gender: Unisex

3 bought

NOW

£ 9.99

£ 19.99

SKYJO Entertaining Card Game for All Ages

1083 bought

NOW

£ 9.99

£ 29.99

Swiftie Lyric Challenge Card Game - TTPD Included

120 bought

NOW

£ 14.99

£ 29.99

Kids Against Maturity Family Card Game - Ages 8+, Hilarious Educational Party Toy

13 bought

NOW

£ 10.88

£ 16.99

Phase 10 Masters Card Game - Strategic Family Toy, Ages 8+, Multiplayer Fun

- Brand: MAQIO LIMITED

- Gender: Unisex

1 bought

NOW

£ 24.99

£ 59.99

Automatic 360° Poker Card Dealer with LED Display for 8 Players

58 bought

NOW

£ 8.99

£ 19.99

Spooky Halloween Craft Kit Bundles - 3 Options w/ Markers, Mirror Cards, Stamps & More

NOW

£ 16.99

£ 39.99

Poker Card Glitter Evening Clutch Bag, Design 5

NOW

£ 6.99

£ 19.99

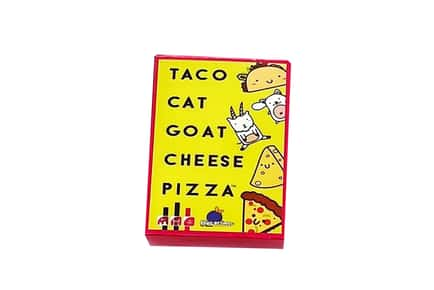

Taco Cat Goat Cheese Pizza Fast-Paced Family Card Game - Ages 8+, Multiplayer, Party Fun

102 bought

NOW

£ 2.99

£ 7.99

RFID Anti-Theft Signal Blocker Pouch - Secure Smart Key Fob & Card Protector for Home Cinema Setups

2 bought

NOW

£ 2.99

£ 5.99

Home D e9cor Bathroom Wall Art Prints - Modern A4 Textured Card, Humorous Designs

NOW

£ 12.99

£ 29.99

Kids' Large Screen Educational Card Reader - Durable Plastic, Giraffe Design, 60 Double-Sided Flashcards

10 bought

NOW

£ 9.99

£ 29.99

Elf on the Shelf Christmas Countdown Magic Kit - 24 or 30 Days, Creative Props & Activity Cards

825 bought

NOW

£ 6.99

£ 19.99

Funny Hen Party Card Games - Cheeky Gag Gift Pack for Bridal Showers & Girls' Nights

1 bought

NOW

£ 39.00

£ 59.99

Kids 4K Ultra-High Definition Digital Camera - 2.88" Screen, 32GB Card, 12 Modes, Lightweight Action Cam

8 bought

NOW

£ 4.99

£ 19.99

Goyard-inspired Faux Leather Card Wallet, 7

4 bought

NOW

£ 6.99

£ 19.99

Plaid Canvas & PU Leather Card Holder Purse - Compact 20-Slot Women's Wallet Organizer

2 bought

NOW

£ 5.99

£ 9.99

Premium Card Gift Bags with Rope Handles - Black or White (Pack of 5, 14.8cm x 12cm x 7cm)

Discover great deals on managing your card limit with Wowcher. From credit limit increase offers and budgeting tools to trusted financial services that help you monitor and optimise your spending, our curated selection makes it easy to take control of your finances without overspending.

Whether you’re aiming to raise your credit limit for larger purchases, tighten control with spending caps, or simply improve your credit score through responsible usage, you’ll find offers that suit every UK budget. Explore discounts on credit monitoring, budgeting apps, debt simplification, and secure cards designed to help you manage your card limit more effectively.

Unbeatable Deals on Card Limit Related Tools

Our selection includes credit limit increase offers, UK credit monitoring services, and budgeting software that helps you track spending limits across multiple cards. You’ll also find prepaid cards with controlled limits, as well as secure credit cards designed for building or rebuilding your credit limit over time.

If you’re concerned about overspending, look for offers on debt consolidation loans and balance transfer deals that provide a clear path to manage card limits more efficiently while protecting your credit score.

Frequently Asked Questions

What to Consider When Managing Card Limits?

First, understand your current credit utilization. This is the percentage of your available credit limit you’re using. Keeping utilization below 30% generally helps protect your credit score and improves your chances of future increases.

Next, review the terms of any credit limit increase offer. Some lenders perform soft pulls that won’t affect your score, while others may request a hard inquiry. Consider your repayment plan and ensure you can comfortably manage higher monthly minimums.

Think about budgeting tools and alerts that enforce spending limits across cards. This creates a practical system where you can enjoy larger purchases when needed while avoiding impulsive overspending.

What Are the Most Popular Types of Card Limits?

Credit cards with a higher credit limit can help your credit utilization ratio, but they come with responsibility. Secured cards often start with lower limits, making them a good option for building or repairing credit while you learn discipline around spending.

Debit cards and prepaid cards offer lower or controlled spending limits, which can be ideal for budgeting, teenagers, or gift cards. For those rebuilding credit, a card with a sensible card limit and clear repayment terms can be a stepping stone toward higher limits in the future.

How to Maintain Healthy Card Limit Usage?

Set monthly budget targets and enable alerts when you approach your planned spending limit. Regularly review statements for unfamiliar transactions, ensuring your available credit matches your actual purchases. Practicing timely payments sustains a positive credit history and opens doors to better credit limits later on.

Combine monitoring services with smart habits: pay more than the minimum when possible, avoid cash advances, and keep old accounts in good standing to support your overall credit profile.

What Are the Best Ways to Increase a Card Limit in the UK?

Start with a gentle request if you’ve had a stable income and on-time payments. A gentle approach often yields a favorable demand for an increased credit limit. If your score has improved or you’ve added income, explain these changes politely and provide relevant documentation to strengthen your case.

Consider a professional review from a financial advisor if you’re unsure about the impact on your credit score or long-term finances. In the UK, many lenders perform a soft credit check for limit increases, which doesn’t affect your score, but some may perform a hard inquiry. Always weigh the potential impact before applying.

What is a card limit and why does it matter?

A card limit, also known as credit limit, is the maximum balance you can owe on a credit card or the spending cap on a debit or prepaid card. It matters because it affects your purchasing power, how lenders view your risk, and your credit utilization ratio, which can influence your credit score and eligibility for future credit limit increases.

How can I increase my credit card limit UK?

To increase your limit in the UK, review your current finances, ensure on-time payments, and consider your income stability. You can request an increase online or via phone. Some banks run soft checks that don’t impact your score, while others may perform a hard inquiry. Provide supporting documents if requested and be prepared to explain why you need a higher limit.

Will increasing my card limit hurt my credit score?

An increased limit can improve your credit utilization ratio if your overall spending doesn’t rise proportionally. However, a hard inquiry from the lender can briefly dip your score. Responsible use, regular payments, and maintaining a healthy utilization help sustain or improve your score over time.

Are there safer alternatives to raising a card limit?

Yes. Consider budgeting apps and alerts to control spending limits, using a debit card or prepaid card for everyday purchases, or opting for a secured card with a lower card limit to rebuild credit gradually. These options can help you manage spending while you work toward a future credit limit increase.